Providing employees with great benefits shouldn’t be that hard.

Business owners need to provide health care coverage to their employees but they are stuck with expensive options that give their employees inconvenient, impersonal care.

Until now.

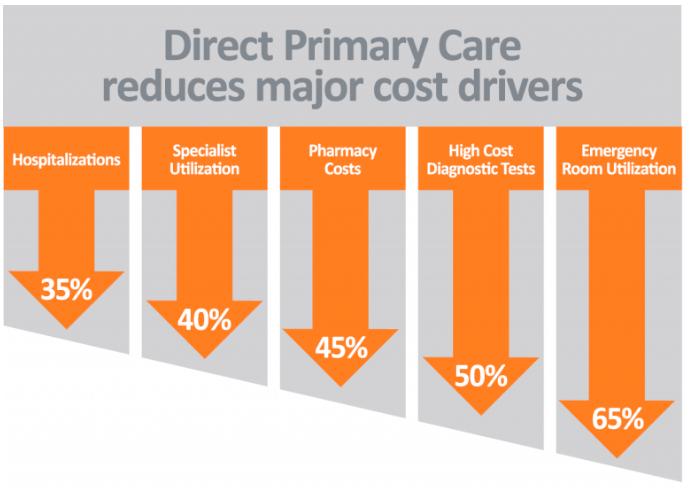

Balanced Physician Care offers business owners a plan that drastically reduces their costs, and gives their employees healthcare they will rave about.

Personalized Primary Care

Studies show that stronger relationships between patients and doctors result in better outcomes and lower costs. That’s why at Balanced Physician Care, we treat your employees as people—not just a set of illnesses and conditions.

24/7 Access

We know that health care issues often arise outside of standard office hours. That’s why we provide your employees with their doctor’s cell phone and email address. They’ll be supported around the clock—with great care just a phone call or email away

Employee Health Promotion

Your employees are a unique community. That’s why we take time to understand your company culture and identify its strengths and weaknesses. Then, we collaborate with your employees to craft the programs they want, that deliver the results you need.

The Bottom Line: Savings

Balanced Physician Care offers business owners a plan that drastically reduces their costs, and gives their employees healthcare they will rave about while keeping them happier, healthier, and more productive

Always Open Enrollment

Determine if your company desires an open enrollment period; alternatively, we can enroll people on an ongoing basis. Employees sign up by following your company-specific link provided once we set up your account on our management program, Hint Health.

Custom Solutions

We pride ourselves on being flexible to our clients’ unique needs—and are experts at designing innovative solutions that align with your organization’s goals. Have a health care or utilization problem and don’t know where to start? Let us help you find the right path forward.

Balancing Cost, Care, and Improved Health

membership gives your employees convenient, unrestricted access to a physician they know and trust at a set monthly rate. Members never avoid getting care because they can email, call, send pictures, and video chat with their doctor.

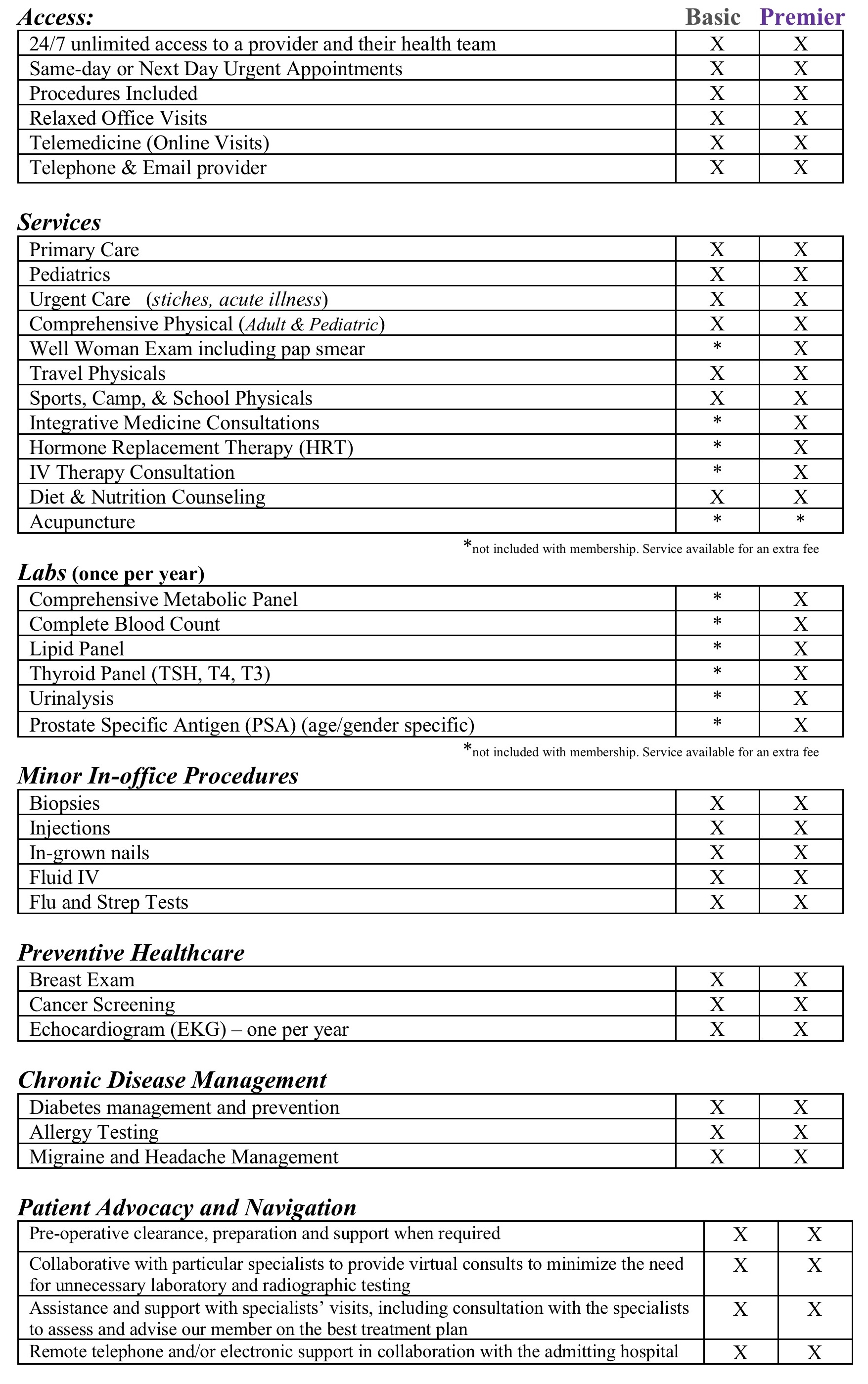

The best benefits in the business.

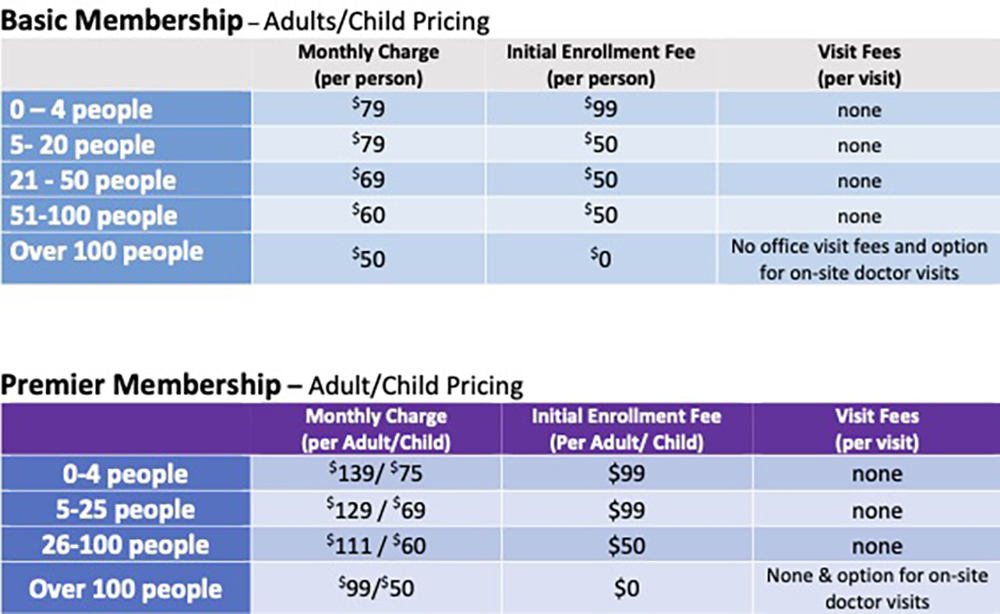

Give your employees REAL benefits with two groundbreaking healthcare plan options.

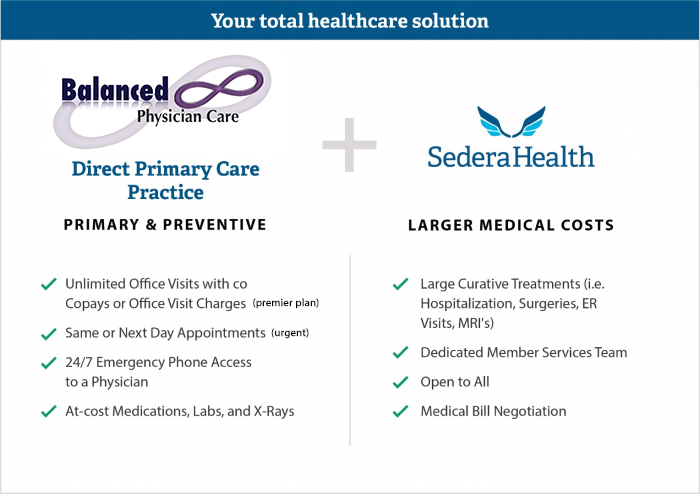

1) Balanced Physician Care Membership or 2) Membership plus a Sedera Health Plan.

| Under 30 | Over 30 | |

|---|---|---|

| Employee Only | $237 | $278 |

| Employee + Spouse | $530 | $583 |

| Employee + Children | $459 | $520 |

| Employee + Family | $803 | $870 |

| Under 30 | Over 30 | |

|---|---|---|

| Employee Only | $206 | $236 |

| Employee + Spouse | $451 | $490 |

| Employee + Children | $393 | $438 |

| Employee + Family | $690 | $738 |

| Under 30 | Over 30 | |

|---|---|---|

| Employee Only | $188 | $212 |

| Employee + Spouse | $404 | $434 |

| Employee + Children | $354 | $390 |

| Employee + Family | $622 | $660 |

*All contribution amounts above include a Balanced Physician Care Basic Membership as well.

WHAT IS SEDERA?

A medical cost sharing community.

Sedera is a membership-based non-insurance arrangement established for the purpose of sharing legitimate health care expenses between Members.

Can a Small Employer Pay for DPC for its Employees?

Yes! The most likely scenario for DPC practices is that you are approached by a employer of less than 50 employees that wants to sponsor DPC. This employer was not required to buy insurance for its employees, but now does not want to be subject to a $100 per day fine per employee. Fortunately this $100 per day fine is now nothing more than a theoretical problem.

On Dec 8, 2016 with the passage of H.R. 34: 21st Century Cures Act the potential for a $100 per day fine for the less than fifty employers desiring to pay for DPC services with pretax dollars has largely been eliminated. See for yourself by reading the language under Title XVIII Other Provisions Sec 18001 titled "Exception from group health plan requirements for qualified small employer health reimbursement arrangements." The most important subsection reads as follows:

"An arrangement is described in this subparagraph if—

(i)such arrangement is funded solely by an eligible employer and no salary reduction contributions may be made under such arrangement,

(ii)such arrangement provides, after the employee provides proof of coverage, for the payment of, or reimbursement of, an eligible employee for expenses for medical care (as defined in section 213(d)) incurred by the eligible employee or the eligible employee’s family members (as determined under the terms of the arrangement), and

(iii)the amount of payments and reimbursements described in clause (ii) for any year do not exceed $4,950 ($10,000 in the case of an arrangement that also provides for payments or reimbursements for family members of the employee)."

Almost any method of structuring the payment arrangement will now permit you to avoid the fine. The old method was to make sure the employer paid the DPC fees with after tax dollars, and of course gave the employees the option to take cash rather than enroll in the DPC practice. Historically we could also make the odd argument that technically the IRS claims that DPC fees are not currently an eligible 213(d) expense. With the passage of the CURES Act neither of these designs or arguments are necessary. As long as the arrangement is funded solely by the employer for 213(d) expenses and it costs less than $4,950 per individual or $10,000 per family per year then we do not have a problem. As readers can realize - for this particular issue - the only way the small business faces a fine is if the DPC practice is charging a monthly membership fee greater than $412.50 per month. Whether the IRS deemed it a 213(d) expense or not makes no difference in the final outcome - no $100 per employee per day fine would apply in either circumstance.

The employer will want to ask each employee to attest to having some kind of minimum essential (MEC) coverage, but there need be no formal audit regarding this attestation. Please see IRS Notice 2017-67 page 27 and 28. Proof could consist of "an attestation by the employee stating that the employee and the individual have MEC, the date coverage began, and the name of the provider of the coverage." Further "An eligible employer may rely on the employee’s attestation unless the employer has actual knowledge that the individual whose expense is submitted does not have MEC."

If the employer does provide a qualified plan, either through the purchase of a traditional plan or via a self insured / stop loss policy, then the employer may also purchase DPC for its employees without concern for the $100 daily fine. For more introductory information see this IRS discussion of Employer Health Care Arrangements. Additional FAQs from the Department of Labor are answered here.

Those readers that want to dig into the details should also review IRS Notice 2013-54 and IRS Notice 2015-17 (especially Questions 4 and 5). These complicated discussions are difficult even for attorneys and accountants. I will attempt to summarize my reading. If you are dealing with an employer (likely fewer than 50 employees) that does not want to be stuck with the $100 per employee per day fine, you will need to argue that the employer's decision to purchase DPC for its employees does NOT amount to a "Health Reimbursement Arrangement." The IRS says that a HRA is "an arrangement that is funded solely by an employer and that reimburses an employee for medical care expenses as defined under Code section 213(d)." At this stage, you could launch two potential defenses: 1) structure the DPC arrangement such that each individual patient must pay part of the monthly fee so that the employer is not "solely" funding the arrangement, or 2) you could (ironically) argue that DPC is not a recognized medical care expense under section 213(d).

Can a large employer pay for DPC for its Employees?

Yes, and the best way to do this has recently changed. EBHRAs (Excepted Benefit Health Reimbursement Accounts) with an on site DPC clinic are the best way for employers to pay for DPC in a tax advantaged way.

While there may be an argument that ICHRAs can fund DPC this is less clear, and the employer would be limited in its ability to endorse a specific DPC practice with an ICHRA (Individual Coverage Health Reimbursement Account), but this is easily achieved with an EBHRA. Readers will want to review the following Federal Register language (82 FR 28,888)